Introduced in 2015, the Prologis Logistics Rent Index examines trends in net effective market rental growth in key logistics real estate markets in North America, Europe, Asia and Latin America. Our proprietary methodology focuses on taking rents, net of concessions, for logistics facilities.

This index combines the company’s local insights on market pricing dynamics with data from our global portfolio. Rental rates at the regional and global levels are weighted averages based on estimates of market revenue.

Takeaways:

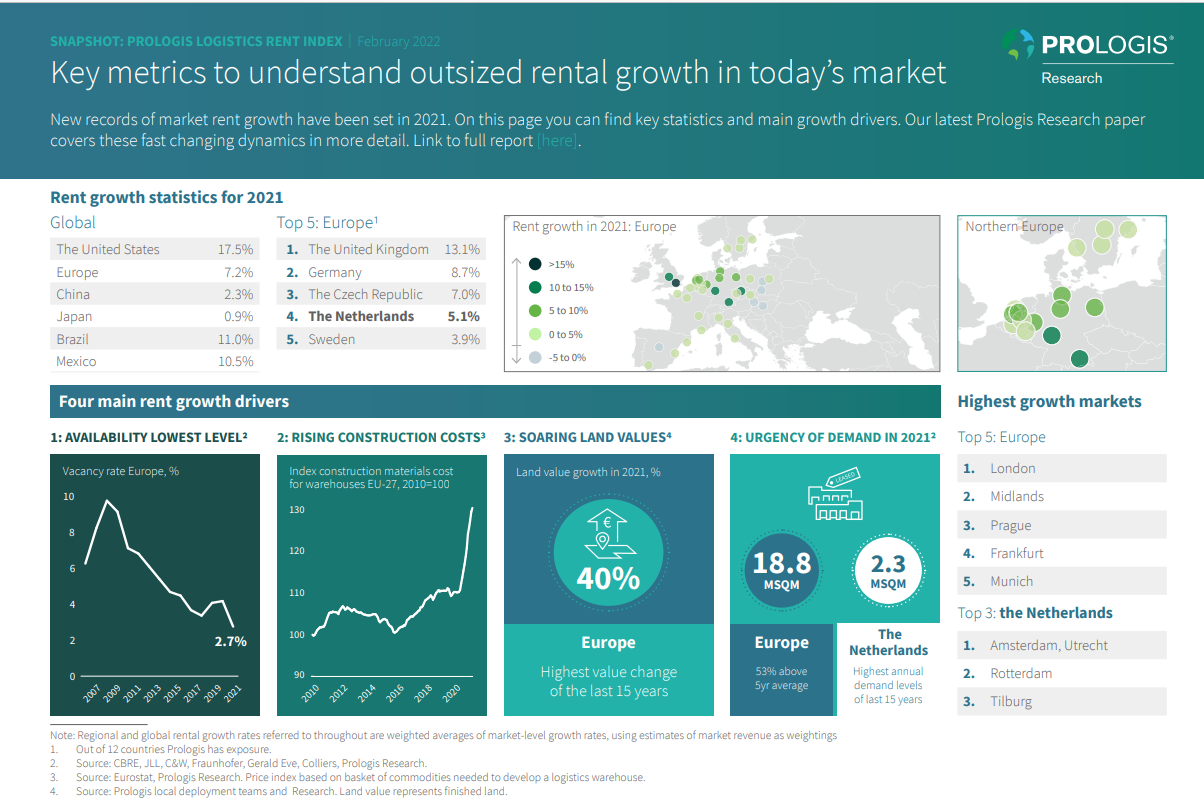

- Bidding wars are increasing as available logistics space drops. As demand outstrips supply, vacancies are at record lows across the globe.

- Record demand stems from a stronger economy and industry-specific factors, such as the rise of e-commerce. Also a factor: Retailers are boosting inventories to make sure consumers get their goods on time.

- Spiking construction costs and land prices produced record high replacement costs. Developers have had to increase rents to bring on much-needed supply.

Dirk Sosef, Vice President, Research & Strategy, Europe adds: “2021 was a record year for European rent growth and this upward trajectory is set to continue in 2022. Multiple indicators, including high demand, low availability, and the rising replacement costs, are fuelling this outlook. Last year, the strongest rent growth was evident in the UK, but in 2022 we are expecting to see more uniform growth spanning our main European markets.”

Download the Prologis Rent Index Paper here.

Download the Infographic for the Netherlands here. Or read the interview with Sander Breugelmans on Vastgoedmarkt.nl about the Prologis Logistics Rent Index paper of2021 here .