Continued momentum for European logistics real estate in 2019

It’s no surprise that expansion of the European logistics real estate market continued in 2018, with another strong year for occupier demand, lowest vacancy rates and long anticipated rent growth began to materialize. At the start of 2019 concerns increased around capital market volatility and potential impact to global GDP due to US-China trade tensions and Brexit. Even though the logistics real estate market ended 2018 on a strong note, some increased concerns at the start of the year raises the inevitable question: what can we expect in 2019?

Sander Breugelmans on 2019

“We had a strong 2018. Our Benelux portfolio is in a very good shape. We are looking forward to what’s to come in 2019 with a market that is characterized by an ongoing and strong demand for modern logistics space and high occupancy rates. We keep on looking for opportunities to develop or to redevelop in order to offer our customers flexibility of scale at the locations that matter most, the logistics hot spots.”

First, European logistics real estate markets built strong momentum in 2018, a positive for more expansion in 2019. On a pan-European basis, net effective rents were up approximately 4.5% in 2018 and similar rates are expected in 2019 – this is at the highest since the turn of the century when a true pan-European logistics market emerged¹. Just as in 2018, rent growth is expected to be driven by continental markets such as Poland, Germany, France, Czech Republic and Italy after an elongated period of moderate growth. Though in the last few years there were some pockets of rent growth, in 2019, the vast majority of continental markets are expected to experience considerable rent increase.

Source: Prologis Research, IMF, CBRE, JLL, Fraunhofer, Gerald Eve, Cushman & Wakefield, Colliers

Second, there are multiple drivers lifting the markets higher. Market fundamentals are strong, with positive customer sentiment, robust demand, disciplined supply, land scarcity and historic low vacancy. Demand is expected to remain strong, and European market vacancy is expected to remain at low levels¹. This pace of change is expected to be even more rapid in the coming years with e-commerce and Last Touch® taking hold. Second, rents are still at a discount compared to prior benchmarks and replacement-cost rents in most markets. Rents need to rise to justify new construction. Third, replacement costs are rising, driven by increasing construction costs and land prices, affecting development underwriting and pushing rent growth in most markets.

Third, growth is spreading to the Continent. A trend that took off in 2018 is the spread of growth from the United Kingdom to the continent. Three to five years ago, the UK was the primary driver of growth for Europe. Despite Brexit uncertainty, demand in this market remains at healthy levels and vacancy is low, with modern stock vacancy at <3%². On the continent, two different types of growth markets can be observed. First, robust rent growth in mature markets such as Munich, Southern Netherlands, Gothenburg and Prague is on the rise. These markets have already experienced growth and it should persist in 2019. The second group of markets such as Paris, Warsaw, Silesia, and Milan are in the early phase of the rent cycle. Rent growth in these markets starts at a low base with significant potential in 2019 due to robust market conditions. In fact, most of these markets already saw significant growth in 2018.

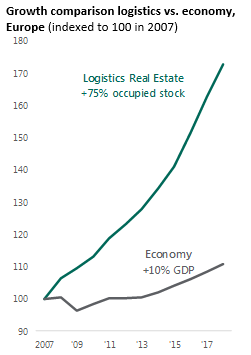

Increasing turmoil. Like capital market volatility, trade tensions and Brexit could potentially impact the overall economy and ultimately the European logistics market. However, the European market is driven by structural demand drivers like supply chain reconfiguration and rising adoption rates. These structural drivers have largely isolated these risks over the last decade, a trend we have steadily observed already. Since 2007 the European logistics real estate market expanded by 75% while the economy grew by 10%.

Fourth, the logistics sector expects growth beyond 2019. Structural drivers such as e-commerce, urbanization and reconfiguration should lead to increased demand for institutional logistics real estate during any phase of the economic cycle. In fact, with the structural changes, customers are meticulously evaluating end-to-end total network costs versus individual operations for transportation, real estate and labour – a best practice being increasingly adopted by forward-thinking customers. Optimising a supply chain often means securing infill logistics real estate for better service to end consumers and lower costs, a net positive for real estate, which today represents just 5% of supply chain costs¹. In fact, Prologis Research recently conducted a study which demonstrated that each 1% savings on transportation and labour equates to 15%-20% of rent for logistics real estate. Therefore and rightly so, real estate is being viewed as a value driver versus a cost factor. From a capital markets perspective, lower cap rates and core return requirements change the development equation, creating a tailwind for rental growth. All this combined with reduced land availability, particularly in infill locations, is setting the engines of growth in motion for the long run.

Bottom line: Expect strong performance in 2019. Although rental increase should drive growth in the European logistics markets, particularly in the urban infill, political or economic risks can always disrupt projected trends. Market conditions remain strong and particularly structural demand drivers back the outlook. With the rise in 2018, and urbanization, e-commerce and demand for Last Touch® as tailwinds, a continued momentum is expected for European logistics real estate in 2019.

Footnotes:

1: Prologis Research

2: Prologis Research, Gerald Eve